Jaguar Nickel Sulphide Project

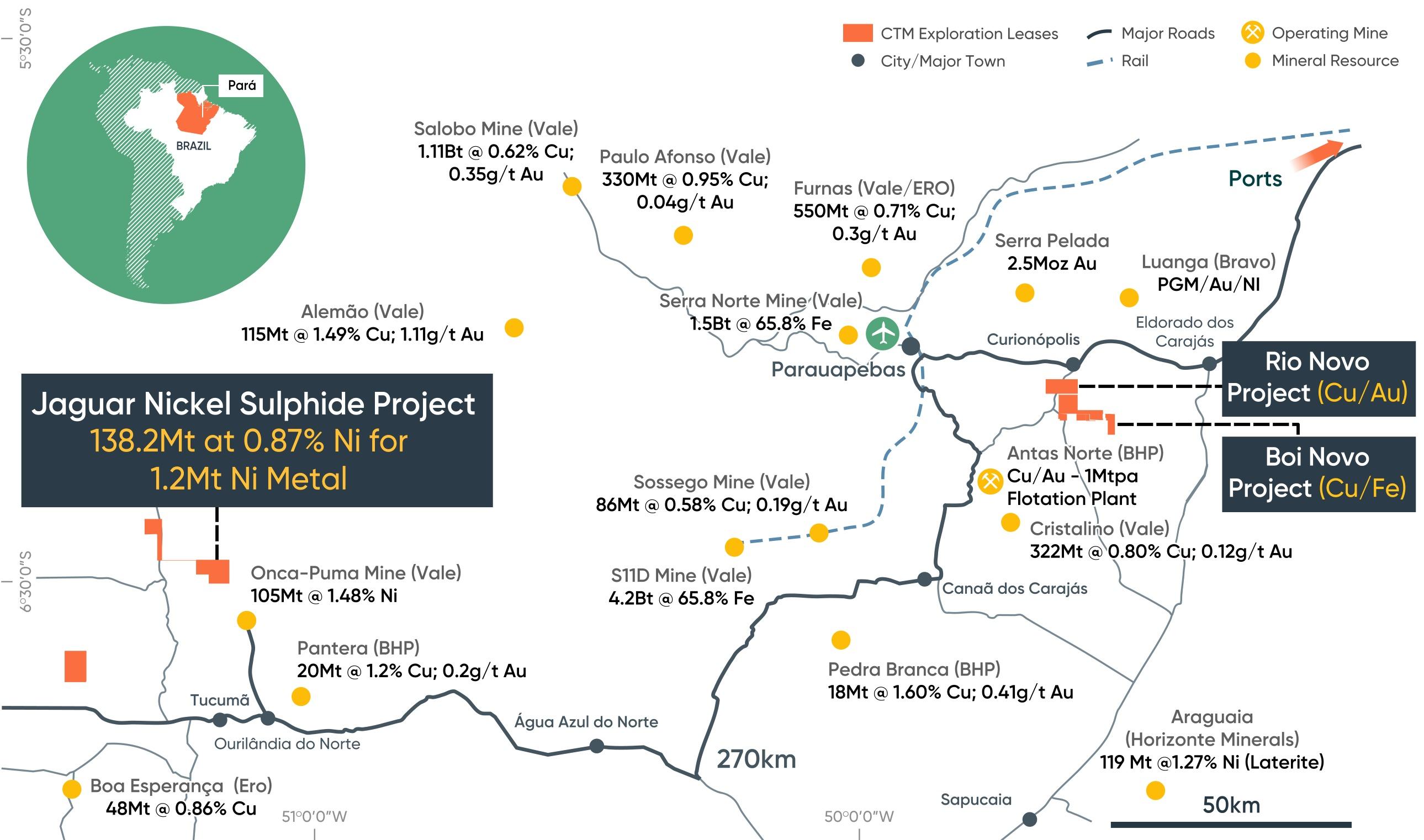

The Jaguar Nickel Sulphide Project is located in the western portion of the world-class Carajás Mineral Province of Brazil, and was acquired from global mining giant, Vale S.A., in April 2020. The Jaguar Project includes multiple nickel sulphide deposits and exploration targets within a 30km2 land package.

Jaguar represents an exceptional exploration, growth and development opportunity in the international nickel sulphide sector and forms the cornerstone of Centaurus’ ambition to build a diversified Brazilian critical minerals business with best-in-class ESG credentials.

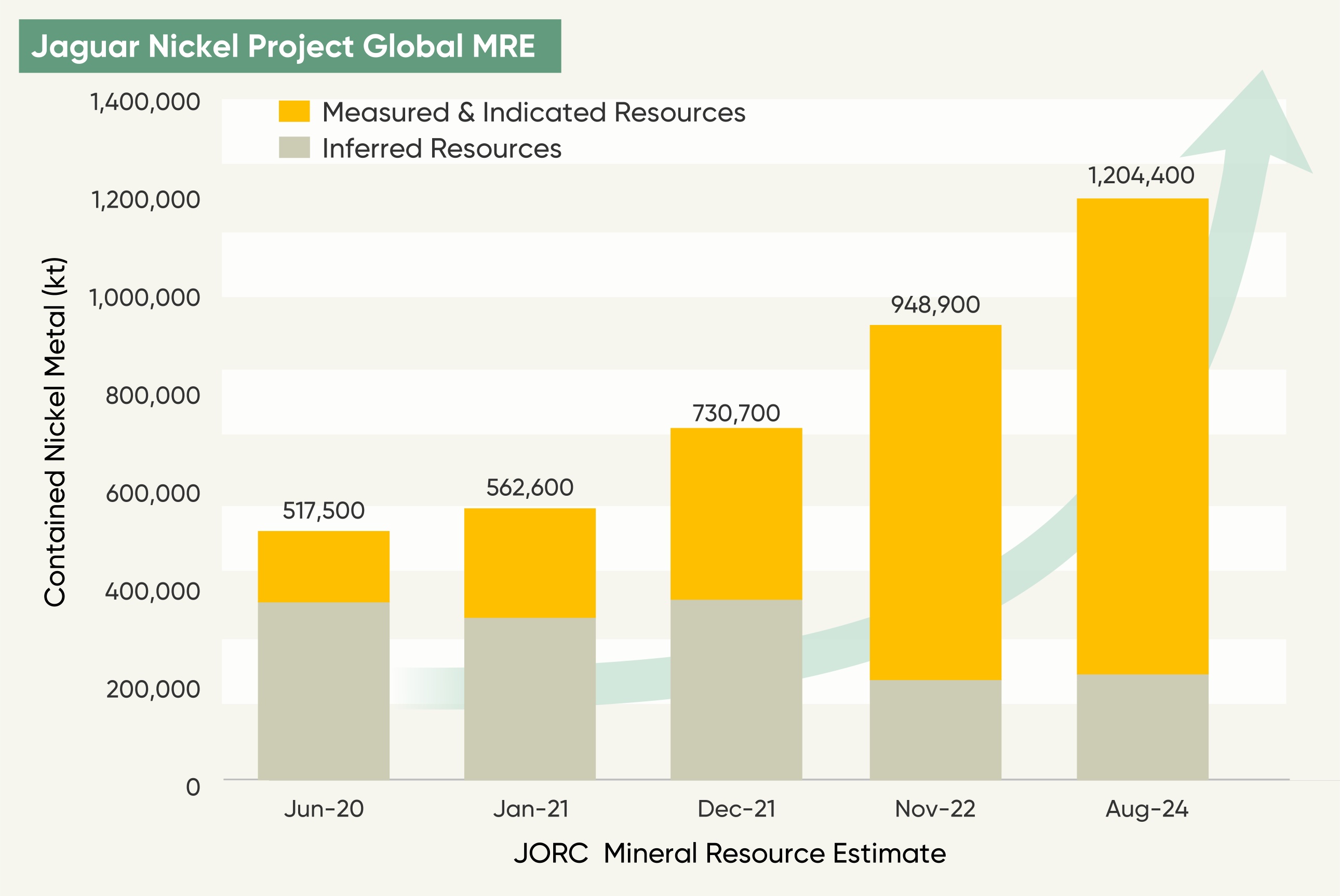

Since completing the acquisition, Centaurus has undertaken intensive drilling campaigns to define a global Mineral Resource Estimate (MRE) totalling 138.2Mt @ 0.87% Ni for 1.20Mt of contained nickel. This establishes Jaguar as one of the largest nickel sulphide resources held by an ASX-listed company and the largest outside of the major mining companies. Importantly, almost 1 million tonnes of contained nickel is held in the higher confidence Measured and Indicated Resource categories, representing more than 81% of the Global MRE.

View Resources & Reserves

The Jaguar JORC Mineral Resource Estimate (MRE) Growth – August 2024

A positive Feasibility Study (FS) was completed for the Jaguar Project in July 2024 (based on the November 2022 MRE), demonstrating strong economics and a clear pathway for the development of Jaguar as a sustainable, long-life and low-cost nickel project.

View the Feasibility Study announcement

Based on the expanded MRE announced in August 2024, Centaurus completed Value Engineering Studies aimed at optimising the project’s metallurgical, mining and engineering parameters.

Results from the Jaguar Value Engineering Process (JVEP) were announced in May 2025.

Key outcomes of the JVEP included:

- Updated JORC Proved and Probable open pit Ore Reserve estimate of 52.0Mt @ 0.78% Ni for 406,100t of contained nickel.

- Average annual nickel production of 22,600tpa over first seven years of full production, delivering free operating cash-flows over this period of US$169 million pa (A$264 million pa).

- Forecast production averaging 18,700tpa of nickel over an initial 15-year open pit mine life via a conventional 3.5Mtpa nickel flotation circuit.

- Low capital intensity, with pre-production CAPEX of US$380 million (including pre-strip and contingency).

- First quartile C1 cash cost of US2.67/lb and AISC of US$3.55/lb (contained nickel basis).

- Post Tax operating cash flow of US$2.00 billion (A$2.53 billion).

- Post Tax Net Present Value (NPV8) of A$1.15 billion and an Internal Rate of Return (IRR) of 34% pa.

- Life-of-Mine (LOM) nickel price assumption of US$19,800/tonne (US$8.98/lb) and 80% nickel payability.

- Capital payback of 1.8 years from first nickel concentrate production.

- Final Investment Decision (FID) targeted for H1 2026 once a suitable funding package has been secured.

View the Value Engineering Process announcement

These very positive metrics further enhance the 2024 FS outcomes and confirm Jaguar’s ability to support a financially strong and technically robust mining operation, with globally competitive operating costs and very strong ESG performance thanks to its use of 100% renewable energy.

SUMMARY OF JAGUAR VALUE ENGINEERING PROCESS RESULTS

The key assumptions underpinning the economics of the Jaguar Nickel Sulphide Project are summarised below:

Table 1 - Base Case Financial Model Assumptions and Production Target

|

Assumptions

|

Units

|

JVEP

|

FS

|

|

Average LOM Exchange Rate

|

USD/BRL

|

5.30

|

5.30

|

|

Nickel Price (2024 real terms)

|

US$/tonne

|

19,800

|

19,800

|

|

Nickel Price (2024 real terms)

|

US$/lb

|

8.98

|

8.98

|

|

Nickel payability at Nickel Price

|

%

|

80

|

76

|

|

Corporate tax rate (under SUDAM Program)

|

%

|

15.25

|

15.25

|

|

Discount Rate (real terms)

|

%

|

8

|

8

|

|

Physicals

|

|

Ore Reserves

|

|

52.0Mt @ 0.78% Ni for 406,100t Contained Ni

|

63.0Mt @ 0.73% Ni for 459,200t Contained Ni

|

|

Life of Mine Recovered Nickel

|

t

|

284,000

|

335,300

|

|

Average Life-of-mine Recovery to Concentrate

|

%

|

70

|

73

|

|

Concentrate Grade

|

%

|

30.1

|

12.3

|

Table 2 - Key Project Results Including Capital and Operating Assumptions

|

Key Project Financial Metrics

|

|

Key Financial Results

|

Units

|

JVEP

|

FS

|

|

Total Revenue (Net of Payabilities)

|

US$M

|

4,551

|

5,046

|

|

EBITDA

|

US$M

|

2,448

|

2,631

|

|

Tax Paid

|

US$M

|

262

|

282

|

|

Project Cashflow

|

|

Pre-Tax

|

US$M

|

1,882

|

2,020

|

|

Post Tax

|

US$M

|

1,620

|

1,738

|

|

Post Tax

|

A$M

|

2,531

|

2,614

|

|

Net Present Value (NPV8)

|

|

Pre-Tax

|

US$M

|

874

|

795

|

|

Post Tax

|

US$M

|

735

|

663

|

|

Post Tax

|

A$M

|

1,148

|

997

|

|

Internal Rate of Return (IRR)

|

|

Pre-Tax

|

% pa

|

38

|

34%

|

|

Post Tax

|

% pa

|

34

|

31%

|

|

Capital Payback Period

|

|

Pre-tax

|

Years

|

1.7

|

2.5

|

|

Post Tax

|

Years

|

1.8

|

2.7

|

|

Key Cost Information

|

Units

|

JVEP

|

FS

|

|

Capital Costs

|

|

Pre-Production Development Capital

|

US$M

|

380

|

371

|

|

Sustaining and Deferred Capital

|

US$M

|

182

|

237

|

|

Operating Costs (contained nickel basis)

|

|

C1 Cash Costs

|

US$/lb

|

2.67

|

2.30

|

|

Product Logistics

|

US$/lb

|

0.26

|

0.59

|

|

Royalties

|

US$/lb

|

0.41

|

0.36

|

|

Sustaining and Deferred Capital

|

US$/lb

|

0.29

|

0.32

|

|

By-Product Credits

|

US$/lb

|

(0.08)

|

Nil

|

|

All-in Sustaining Costs (AISC)

|

US$/lb

|

3.55

|

3.57

|